Heads Up, PBMs: New Reporting Requirements for Prescription Drug Coverage in 2020

With the recent passage of The Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment for Patients and Communities Act (the SUPPORT Act), major changes are coming to the Section 111 Mandatory Insurer Reporting requirements for Pharmacy Benefit Managers (PBMs). Prior to the implementation of the SUPPORT Act, prescription drug coverage reporting has been voluntary. Starting January 1, 2020, all Responsible Reporting Entities (RREs) will be required to report prescription drug coverage as part of the Section 111 reporting process.

Under this new requirement, many PBMs that were not previously required to register and submit as an RRE must begin preparing to submit prescription drug coverage information during the first quarter of calendar year 2020.

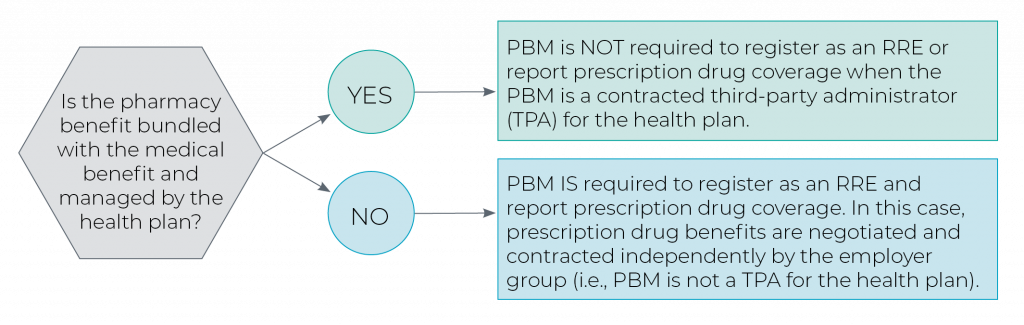

According to the Centers for Medicare and Medicaid Services (CMS), status as an RRE is dependent on the contractual relationship with the employer group. CMS identified PBMs may fall into two distinct categories, based on the pharmacy benefit bundling:

Why This Matters: Section 111 Reporting is Highly Complex

Reporting requirements mandated by Section 111 of the Medicare, Medicaid and SCHIP Extension Act of 2007 are difficult to navigate, and the penalties for noncompliance are high—$1,000 for each day of noncompliance for each individual for which the MSP information should have been submitted. RREs, including PBMs, must collect and maintain extensive member and employer group information in order to report it quarterly to CMS and must reconcile the response files. Inaccurate or incomplete submissions could result in claims over- or underpayments or a surge in demand letters.

PBMs should begin the process now to both determine their status as an RRE, and if required, establish the necessary capabilities to meet this new mandatory reporting requirement.

Ensure Compliance with CMS Regulations

Section 111 reporting is a complex process that requires various quarterly activities to ensure plans remain compliant with CMS rules and regulations. Pareto helps numerous RREs prepare, implement and manage the requirements of Section 111 reporting, with experience spanning back to the implementation of the requirement in 2009. PBMs looking to seamlessly transition through this change in processes can partner with Pareto across any of our Section 111 services:

| Low-Cost Readiness Assessment | Implementation Advisory | Outsourced Section 111 Quarterly Reporting |

|

|

|

Why Pareto?

- Unmatched Experience: 15+ years in this field with 25+ clients

- Data Science-Driven: Proprietary analytics and audit tools ensure correct data for each member

- Compliance Focused: Emphasis on complete and accurate submissions creates peace of mind and minimizes regulatory exposure

To learn more about our Section 111 services for PBMs, contact Matt Krizmanich at mkrizmanich@paretointel.com and (312) 256-8619.